Editorial

|

PEAK 2024 an Outstanding Success

|

|

PEAK 2024 organized by the Midwest Poultry Federation is now well established in the Minneapolis Convention Center that provides more exhibition space, meeting rooms that the previous St. Paul Convention Center. The trade exhibition consistently attracts more turkey-related allied suppliers and contractors compared to the IPPE. The concurrent industry association meetings and educational programs are focused on turkey production given the concentration of farming operations in six Midwest states. A wide range of feeding, ventilation and drinking systems were displayed for floor systems suitable for turkeys and broilers. Technical personnel and representatives were available on booths to discuss operational parameters of equipment, vaccines and medication. PEAK 2024 organized by the Midwest Poultry Federation is now well established in the Minneapolis Convention Center that provides more exhibition space, meeting rooms that the previous St. Paul Convention Center. The trade exhibition consistently attracts more turkey-related allied suppliers and contractors compared to the IPPE. The concurrent industry association meetings and educational programs are focused on turkey production given the concentration of farming operations in six Midwest states. A wide range of feeding, ventilation and drinking systems were displayed for floor systems suitable for turkeys and broilers. Technical personnel and representatives were available on booths to discuss operational parameters of equipment, vaccines and medication.

Educational programs presented included the North Central Avian Disease Conference, the Devenish Nutrition Symposium, and a number of informal gatherings, taking advantage of attendance at the event.

The Midwest Poultry Federation arranged a series of educational presentations for broiler and turkey management, feed technology and business leadership. Topics in the Broiler Track included pre-harvest Salmonella control; Biosecurity and innovations in brooding. The Turkey Track included suppression of pecking injuries, prevention of histomoniasis and advances in management procedures to enhance productivity.

During the trade exhibition, poultry TED Talks were presented detailing innovations in products and management for the benefit of attendees. Topics of interest in live-bird production included vaccination of turkeys against coccidiosis with the introduction of a trivalent Eimeria vaccine; transitioning to non-antibiotic programs, blood biomarkers to detect mycotoxicosis; assessing poult quality; and application of available probiotic feed additives.

Entertainment included PEAK Unhatched, an Exhibition-floor Happy Hour and Hospitality Night.

Despite the prevailing favorable margins in production, there were a number of overhangs that detracted from optimism:

- The resurgence of highly pathogenic avian influenza was a major issue of concern with four large egg-production complexes and one turkey farm diagnosed since the beginning of April. USDA-APHIS has depopulated close to eight million hens in three states, predominantly Michigan, Texas and a limited outbreak in New Mexico. A flock of 70,000 growing turkeys in Minnesota were depopulated. It is evident that HPAI is no longer limited to seasonal epornitics but has expanded beyond the period of migration of waterfowl in spring and fall months. This is in all probability due to transfer of the H5N1 virus to non-migratory species of free-living birds. This is evidenced by dead grackles and pigeons yielding H5N1 virus in the vicinity of the index dairy farm in Texas that was affected with Bovine Influenza-H5N1. Outbreaks of HPAI have been regularly diagnosed on a weekly basis in backyard flocks in widely separated states outside the migratory seasons. These small flocks serve as sentinels for the presence of avian influenza virus and many cases are not diagnosed. Sometime in 2024 the USDA-APHIS will have to accept regional vaccination for turkeys and egg-production flocks. It must be obvious by now that it is futile to attempt to eradicate an endemic infection spread by the aerosol route in addition to fomites.

- The impasse in Congress is impeding passage of legislation necessary to maintain agricultural production. The Farm Bill is mired in dissent in both the Senate and House Agricultural Committees with polarization separating left and right-leaning members. Ultimately there will have to be compromise on the two issues of contention represented by allocation of funds and expanded eligibility for SNAP and WIC favored by the left and diversion of funds from climate change programs to commodity price support on the right. The 118th Congress has barely passed fifty bills as opposed to an anticipated 400 in a normal two-year period. Appropriations bills were delayed by months with passage of stop-gap continuing resolutions avoiding Federal shutdowns. Both parties are to blame for their lack of commitment to the national interest caused by grandstanding and intra-party conflict.

- There are concerns over the soundness of the economy and consumer response. The Federal Reserve has successfully reduced inflation from 8.9 to 3.5 percent but is experiencing difficulty in reducing levels further to the target of 2.0 percent. International conflict and the price of energy are adding to the burden of inflation that is reducing consumer spending despite the last hurrah of extravagance during the first quarter of 2024.

As in all planting seasons, there is concern over the anticipated crop. Yields will be influenced by the projected cyclic transition from an El Nino event through a brief neutral period and the return of a La Nina weather pattern during the late-2024 growing season. As in all planting seasons, there is concern over the anticipated crop. Yields will be influenced by the projected cyclic transition from an El Nino event through a brief neutral period and the return of a La Nina weather pattern during the late-2024 growing season.

It is hoped that the contributions from PEAK 2024 in the form of technical and trade information will be transferred from the event to all U.S. production units and companies with evident improvements in productivity and profitability.

|

|

Poultry Industry News

|

Meat Exports

|

|

U.S. Broiler and Turkey Exports, January-February 2024

OVERVIEW

Total exports of bone-in broiler parts and feet during January-February 2024 attained 573,029 metric tons, 7.2 percent lower than in January-February 2023 (617,370 metric tons). Total value of broiler exports increased by 0.7 percent to $751.8 million ($746.5 million). Total exports of bone-in broiler parts and feet during January-February 2024 attained 573,029 metric tons, 7.2 percent lower than in January-February 2023 (617,370 metric tons). Total value of broiler exports increased by 0.7 percent to $751.8 million ($746.5 million).

Total export volume of turkey products during January-February 2024 attained 33,173 metric tons, 41.7 percent more than in January-February 2023 (23,404 metric tons). Total value of turkey exports increased by 12.7 percent to $90.5 million ($80.3 million).

Unit price for the broiler industry is constrained by the fact that leg quarters comprise over 97 percent of broiler meat exports by volume (excluding feet). From the first quarter of 2021 through 2022, unit value of leg quarters increased consistent with international demand followed by a decline in 2023. Leg quarters represent a relatively low-value undifferentiated commodity lacking in pricing power. Exporters of commodities are subjected to competition from domestic production in importing nations. Generic products such as leg quarters are vulnerable to trade disputes and embargos based on real or contrived disease restrictions.

HPAI has emerged as a panornitic affecting the poultry meat industries of four continents with seasonal outbreaks. The distribution in the U.S. limits eligibility for export depending on restrictions imposed by importing nations

Ongoing outbreaks of African swine fever in China and Southeast Asia from early 2019 and Europe from 2010 onwards reduced the availability of pork. In addition, disruptions in chicken production and logistics due to COVID restrictions decreased availability of protein with international repercussions on trade in chicken and pork. The demand for pork imports to China has diminished with restoration of domestic hog production. Mild overproduction is evident in the white-feathered broiler sector with implications for exports other than feet extending into 2024.

EXPORT VOLUMES AND PRICES FOR BROILER MEAT

During January-February 2024 the National Chicken Council (NCC), citing USDA-FAS data, documented exports of 578,170 metric tons of chicken parts and other forms (whole and prepared), down 6.9 percent from January-February 2023. Exports were valued at $395.0 million with a weighted average unit value of $1,301 per metric ton. During January-February 2024 the National Chicken Council (NCC), citing USDA-FAS data, documented exports of 578,170 metric tons of chicken parts and other forms (whole and prepared), down 6.9 percent from January-February 2023. Exports were valued at $395.0 million with a weighted average unit value of $1,301 per metric ton.

The NCC breakdown of chicken exports for January 2024 by proportion and unit price for each category compared with the corresponding month in 2023 (with the unit price in parentheses) comprised:-

- Chicken parts (excluding feet) 2%; Unit value $1,256 per metric ton ($1,164)

- Prepared chicken 2%; Unit value $4,501 per metric ton ($4,202)

- Whole chicken 6%; Unit value $1,789 per metric ton ($1,593)

- Composite Total 0%; Av. value $1,330 per metric ton ($1,222)

The following table prepared from USDA data circulated by the USAPEEC, compares values for poultry meat exports during January-February 2024 compared with the corresponding months of 2023:-

|

PRODUCT

|

Jan.-Feb. 2023

|

Jan.-Feb. 2024

|

DIFFERENCE

|

|

Broiler Meat & Feet

|

|

|

|

|

Volume (metric tons)

|

617,370

|

573,029

|

-4,432 (-7.2%)

|

|

Value ($ millions)

|

746.5

|

751.8

|

+5.3 (+0.7%)

|

|

Unit value ($/m. ton)

|

1,209

|

1,312

|

+103 (+8.5%)

|

|

Turkey Meat

|

|

|

|

|

Volume (metric tons)

|

23,404

|

33,172

|

+9,768 (+41.7%)

|

|

Value ($ millions)

|

11.2

|

12.2

|

+1.0 ( +8.9%)

|

|

Unit value ($/m. ton)

|

4,786

|

3,678

|

-1,108 (-23.2%)

|

COMPARISON OF U.S. CHICKEN AND TURKEY EXPORTS

JANUARY-FEBRUATY 2024 COMPARED TO 2023

BROILER EXPORTS

Total broiler parts, predominantly leg quarters but including feet, exported during January-February 2024 compared with January-February 2023 declined by 7.2 percent in volume but was up 0.7 percent in value. Unit value was 8.5 percent higher to $1,312 per metric ton. Total broiler parts, predominantly leg quarters but including feet, exported during January-February 2024 compared with January-February 2023 declined by 7.2 percent in volume but was up 0.7 percent in value. Unit value was 8.5 percent higher to $1,312 per metric ton.

During 2023 exports attained 3,635,178 metric tons valued at $4,739 million, down 4.2 percent in volume and down 9.2 percent in value compared to 2022. Unit value was down 9.5 percent to $1,284 per metric ton

Broiler imports in 2023 were projected to attain 72,000 metric tons (158 million lbs.)

The top five importers of broiler meat represented 49.5 percent of shipments during January 2024. The top ten importers comprised 66.9 percent of the total volume reflecting concentration among the significant importing nations.

During January-February 2024 Mexico was the first-ranked importer by volume and value with 124,385 metric tons representing 21.7 percent of export volume up 2.1 percent from January-February 2023. Value at $146.1 million was 19.5 percent of the total for exported broiler products during January-February 2024 and up 17.9 percent from 2023, but with a 16.6 percent increase in unit price to $1,179 per metric ton. Value was up 17.9 percent to $146.7 million with a 12.5 percent increase in unit price to $1,212 per metric ton. During February 2024 volume was up 2.2 percent to 61,325 metric tons and value increased15.0 percent from February 2023 to $74.3 million.

Taiwan was 2nd ranked as an importer during January-February 2024 with 47,439 metric tons valued at $146.7 million up 23.3 percent and 21.4 percent in volume and value respectively, compared to the previous year. Unit price was $1,236 per metric ton.

Cuba was the 3rd largest importer based on volume during January-February 2024 with 46,687 metric tons valued at $53.6 million down 10.5 percent in volume but up 5.9 percent in value compared to January-February 2023. Unit price was $1,146 per metric ton.

During January-February 2024 exports to China, 4th-ranked by volume and 2nd ranked by value represented 7.2 percent by volume and 18.1 percent by value of shipments. Exports were down 47.4 percent in volume to 41,272 metric tons and down 56.4 percent in value to $81.4 million compared to January-February 2023. Unit price was $1,972 per metric ton up 21.5 percent.

For 2023, 405,313 metric tons of U.S. broiler products were shipped to China, valued at $711,172 with an average unit value of $1,755 per metric ton. A breakdown of product categories and prices was provided by USAPEEC. Paws and feet represented 68.5 percent of volume and 73.1 percent of value with a unit price of $1,871 per metric ton. Legs and leg quarters comprising 22.6 percent of volume and 12.8 percent of value were priced at $990 per metric ton below the $1,302 average for all U.S. exports excluding China. Wings comprised 4.6 percent of volume and 5.7 percent of value with a unit price of $2,190 per metric ton. All other poultry products (including 4 tons of duck meat) amounting to 4.2 percent of volume and 8.4 percent of value attained an average unit price of $3,485 per metric ton

During January-February 2023 exports to Hong Kong increased by 222 percent in volume to 14,300 metric tons and 171 percent in value to $21.5 million with a unit price of $1,504 per metric ton. In 2022 and 2023 unit prices were $1,834 and $1,671 per metric ton respectively. Accordingly consignments are presumed to comprise a high proportion of feet with assumed transshipment to the Mainland as in past years.

During January-February 2024 nations gaining in volume compared to the corresponding period in 2022 (with the percentage change indicated) in descending order of volume with ranking indicated by numeral were:-

- Mexico (+1%); 2.Taiwan, (+23%); 5, Guatemala, (+3%); 6. Philippines, (+53%); 7. UAE, (+77%); 9. Viet Nam, (+18%) and 11. Hong-Kong, (+222%).

Losses during January-February 2024 offset the gains in exports with declines for:-

- Cuba, (-10.0%); 4. China, (-47%); 8. Canada, (-4%); 10.Angola, (-23%) 13. Haiti, (-31%).

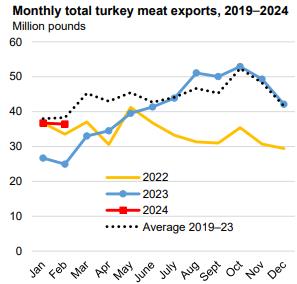

TURKEY EXPORTS

The volume of turkey meat exported during January-February 2024 increased by 41.7 percent to 33,172 metric tons from January-February 2023 and value was 18.9 percent higher to $121.2 million compared to January-February 2023. Average unit value was 23.2 percent lower to $3,678 per metric ton.

Imports of turkey products were projected to rise to 38,640 metric tons in 2023.

For the entire year of 2023 export volume increased by 20.2 percent to 221,098 metric tons compared to 2022 and value fell by 2.0 percent to $620 million reflecting an 18.5 percent decrease in unit value to $2,829 per metric ton.

Mexico was the leading importer of turkey products during January- February 2024 with 24,120 metric tons representing 72.7 percent of total volume of 35,172 metric tons. Value at 64.6 million was 71.4 percent of the total with a unit price of $2,678 per metric ton. Volume was 44.4 percent higher and value was 9.3 percent higher than for January-February 2023.

The regions of the Caribbean (2,722 metric tons); East Asia, (998); Central America, (1,260) and sub-Saharan Africa (1,612) collectively imported 6,592 metric tons of turkey products in January-February 2024 representing 19.9 percent of volume and 20.7 percent of value amounting to $18.7 million. Unit price was $2,536. Regional unit prices per metric ton ranged from $1,652 for the Leeward-Windward Islands to $3,189 for Canada.

During January-February 2024 nations increasing volumes of purchases, albeit over a small base, compared to the corresponding months in 2023 with ranking comprised:-

- Mexico, (+44%); Leeward-Windward Islands, (+45%); Dominican Republic, (+317%) and South Africa, (1,618%)

- Canada reduced imports by 5 percent and 4. Jamaica by 51%).

PROSPECTS FOR 2024

The April 17th 2024 Livestock, Dairy and Poultry Outlook Report, retained the projection for 2023 exports of broiler products at 3.302 million metric tons (7,265 million lbs.). This value represents 15.7 percent of the projected production of 21.083 million metric tons (46,387 million lb.) of broiler RTC by the U.S. industry.

For 2024 exports of broiler products were forecast at 3.209 million metric tons (7,060 million lbs.), equivalent to 14.9 percent of forecast annual production of 21.409 million metric tons (46,875 million lbs.)

Projected export of turkey products in 2023 will be 222,272 metric tons, (489 million lbs.) or 9.0 percent of annual production of 2.481 million metric tons (5,457 million lbs.).

For 2024 exports of turkey products were forecast at 236,400 metric tons (520 million lbs.) equivalent to 9.7 percent of forecast annual production of 2.441 million metric tons (5,375 million lbs.)

It is important to recognize that exports of chicken and turkey meat products to our USMCA partners amounted to $1,264 million in 2021, $1,647 million during 2022 and $1,696 in 2023. It will be necessary for all three parties to the USMCA to respect the terms of the agreement since punitive action against Mexico or Canada on issues unrelated to poultry products will result in reciprocal action by our trading partners to the possible detriment of U.S. agro-industries.

The emergence of H5N1strain avian influenza virus with a Eurasian genome in migratory waterfowl in all four Flyways during 2022 was responsible for sporadic outbreaks of avian influenza in backyard flocks and serious commercial losses in egg-producing complexes and turkey flocks but to a lesser extent in broilers. The probability of outbreaks of HPAI over succeeding weeks appears more likely as spring migration of waterfowl has commenced. Incident cases during April resulted in depletion of 8.5 million hens and a turkey flock. Outbreaks will be a function of shedding by migratory and domestic birds and possibly mammals. The extent of protection of commercial flocks at present relies on the intensity and efficiency of biosecurity, representing investment in structural improvements and operational procedures. These measures are apparently inadequate to provide absolute protection, suggesting the need for preventive vaccination in high-risk areas for egg-producing, breeder and turkey flocks.

The application of restricted county-wide embargos following the limited and regional cases of HPAI in broilers with restoration of eligibility 28 days after decontamination has supported export volume for the U.S. broiler industry. Exports of turkey products were more constrained with plants processing turkeys in Minnesota, the Dakotas, Wisconsin and Iowa impacted. Most nations have now lifted embargos that were previously placed on entire states or counties following outbreaks in the 4th quarter of 2024 as the WOAH mandated post-decontamination period has expired. The challenge will be to gain acceptance for vaccination based on intensive surveillance. Recognition that H5N1 HPAI is panornitic in distribution across six continents and is now seasonally or regionally endemic in many nations with intensive poultry production, suggests that vaccination will have to be accepted among trading partners as an adjunct to control measures in accordance with WOAH policy.

The live-bird market system supplying metropolitan areas, the presence of numerous backyard flocks, fighting cocks and commercial laying hens allowed outside access, potentially in contact with migratory and now some resident bird species, all represent an ongoing danger to the entire U.S. commercial industry. The live-bird segments of U.S. poultry production represent a risk to the export eligibility of the broiler and turkey industries notwithstanding compartmentalization for breeders and regionalization to counties or states for commercial production.

|

Meat Projection April 2024

|

|

Updated USDA-ERS Poultry Meat Projection for April 2024.

On April 17th 2024 the USDA-Economic Research Service released updated production and consumption data with respect to broilers and turkeys, covering 2022 (actual), a revised projection for 2023 and a forecast for 2024. On April 17th 2024 the USDA-Economic Research Service released updated production and consumption data with respect to broilers and turkeys, covering 2022 (actual), a revised projection for 2023 and a forecast for 2024.

The 2023 projection for broiler production is 46,387 million lbs. (21.085 million metric tons) up 0.4 percent from 2022 and less than a 0.1 percent upward adjustment from the February 2024 report. USDA projected per capita consumption of 99.5 lbs. (45.2 kg.) for 2023, down 0.1 percent from 2022. Exports will attain 7,265 million lbs. (3.302 million metric tons), 0.1 percent below the previous year.

The 2024 USDA forecast for broiler production will be 47,100 million lbs. (21.409 million metric tons) up 1.5 percent from 2023 with per capita consumption up 0.8 lb. to 100.3 lbs. (45.6 kg). Exports will be 2.8 percent lower compared to 2023 at 7,060 million lbs. (3.209 million metric tons), equivalent to 14.9 percent of production.

Production values for the broiler and turkey segments of the U.S. poultry meat industry are tabulated below:-

|

Parameter

|

2022

(actual)

|

2023

(projection)

|

2024

(forecast)

|

Difference

2023 to 2024

|

|

Broilers

|

|

|

|

|

|

Production (million lbs.)

|

46,207

|

46,387

|

47,100

|

+1.5

|

|

Consumption (lbs. per capita)

|

98.9

|

99.5

|

100.3

|

+0.8

|

|

Exports (million lbs.)

|

7,290

|

7,265

|

7,060

|

-2.8

|

|

Proportion of production (%)

|

15.8

|

15.7

|

14.9

|

-5.1

|

|

|

|

|

|

|

|

Turkeys

|

|

|

|

|

|

Production (million lbs.)

|

5,222

|

5,457

|

5,375

|

-1.5

|

|

Consumption (lbs. per capita)

|

14.6

|

14.8

|

14.6

|

-1.4

|

|

Exports (million lbs.)

|

407

|

489

|

520

|

+6.3

|

|

Proportion of production (%)

|

7.8

|

9.0

|

9.7

|

7.8

|

Source: Livestock, Dairy and Poultry Outlook released April 17th 2024

The April USDA report updated projection for the turkey industry for 2023 including annual production of 5,457 million lbs. (2.480 million metric tons), up 4.5 percent from 2022. Consumption in 2023 was projected to be 14.8 lbs. (6.7 kg.) per capita, up 1.4 percent from the previous year. Export volume will increase by 20.1 percent in 2023 to 489 million lbs. (222,272 metric tons). Values for production and consumption of RTC turkey in 2023 are considered to be realistic, given year to date data, the prevailing economy, variable weekly poult placements, production levels, freedom from HPAI and inventories. The April USDA report updated projection for the turkey industry for 2023 including annual production of 5,457 million lbs. (2.480 million metric tons), up 4.5 percent from 2022. Consumption in 2023 was projected to be 14.8 lbs. (6.7 kg.) per capita, up 1.4 percent from the previous year. Export volume will increase by 20.1 percent in 2023 to 489 million lbs. (222,272 metric tons). Values for production and consumption of RTC turkey in 2023 are considered to be realistic, given year to date data, the prevailing economy, variable weekly poult placements, production levels, freedom from HPAI and inventories.

The 2024 forecast for turkey production will be 5,375 million lbs. (2.443 million metric tons) down 1.5 percent from 2023 with per capita consumption down 1.4 percent to 14.6 lbs. (6.6 kg). Exports will be 6.3 percent higher than in 2023 to 520 million lbs. (236,000 metric tons) equivalent to 9.7 percent of production.

Export projections do not allow for a breakdown in trade relations with existing major partners including Mexico, Canada and China nor the impact of catastrophic diseases including HPAI and vvND in either the U.S. or importing nations

The USDA export projection takes into account declining broiler product exports to China. For 2022, China imported 622,099 tons of broiler products valued at $1,087 million including feet at an average unit price of $1,263 per ton. Feet represented 77.8 percent of volume during 2022 (483,538 metric tons) at a unit price of $1,926 per ton. Compared to 2022, exports to China during 2023 were 34 percent lower in volume to 405,343 metric tons and 34 percent lower in value to $711 million.

Subscribers are referred to the monthly export report in this edition and update of production data and cold storage inventories of broilers and turkeys respectively posted in each end-of- month edition of CHICK-NEWS with the previous monthly data under the STATISTICS tab.

|

House of Raeford Plant in Aiken SC. on Hold

|

|

According to news reports, the proposed House of Raeford broiler plant is unlikely to proceed in the selected location in South Carolina. The Aiken City Council has declined to change an ordinance to approve the facility. The problem relates to available wastewater treatment capacity. According to the County Council, the City of Aiken can process a maximum of 500,000 gallons of additional capacity per day with the proposed plant requiring 1.7 million gallons using current wastewater treatment technology. According to news reports, the proposed House of Raeford broiler plant is unlikely to proceed in the selected location in South Carolina. The Aiken City Council has declined to change an ordinance to approve the facility. The problem relates to available wastewater treatment capacity. According to the County Council, the City of Aiken can process a maximum of 500,000 gallons of additional capacity per day with the proposed plant requiring 1.7 million gallons using current wastewater treatment technology.

South Carolina Governor Henry McMaster, is in favor of the project based on job creation and the substantial economic impact. He noted, “I am committed to assist in identifying state funding to help address water and sewer infrastructure so that Aiken County will accommodate both the House of Raeford plant and to have sufficient capacity for future growth.”

The discrepancy between available wastewater processing capacity in Aiken County and the needs of House of Raeford should have eliminated the location for a proposed plant in the initial site evaluation. Failure to identify this preeminent restraint suggests a lack of coordination in conducting the preliminary feasibility study.

The need for a new plant is indicated by the age of the West Columbia plant erected in1959 and acquired by Raeford in 1998. The location in an area undergoing gentrification is now inconsistent with the community and is engendering opposition to its presence based on odor and depression of property values.

|

Danish Crown Consolidating Production Facilities

|

|

Faced with declining demand for pork and the challenges of African swine fever, Danish Crown a major multinational pork producer has announced the intended closure of the Ringsted Packing Plant, currently employing 1,200. Faced with declining demand for pork and the challenges of African swine fever, Danish Crown a major multinational pork producer has announced the intended closure of the Ringsted Packing Plant, currently employing 1,200.

Jais Valeur, Group CEO stated, “It is a heavy decision to close the abattoir in Ringsted but is a necessary measure in our efforts to develop Danish Crown as a modern food company.” He added, “In making these changes we are doing all we can to improve efficiency at the abattoirs and to sell many more processed products to our key European customers.”

The production capacity at Ringsted will be transferred to other plants in Denmark. It is intended to offer positions at these facilities to displaced employees. Savings from closing the Ringsted plant will be applied to improve efficiency at four other facilities, creating 300 new positions over three years.

Since 2021, Danish Crown has followed a strategy of providing further-processed pork items and has invested in production capacity in other markets including the U.K.

The decision to rationalize production and to concentrate on higher-value items parallels the recent decisions by Tyson Foods in the U.S. and Olymel in Canada to close obsolete or unprofitable plants and to consolidate production capacity.

|

Huvepharma Launches Coccidiosis Vaccine for Turkeys

|

|

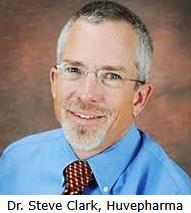

Huvepharma has received approval and has released a trivalent oocyst vaccine for turkeys. The product incorporates three species, Eimeria adenoeides, E. meleagrimitis and E. gallopavonis. Huvepharma has received approval and has released a trivalent oocyst vaccine for turkeys. The product incorporates three species, Eimeria adenoeides, E. meleagrimitis and E. gallopavonis.

The Huvepharma turkey coccidiosis vaccine is intended to provide optimum protection with minimal post-vaccination reaction. The oocyst suspension can be administered orally or by hatchery spray. The Huvepharma turkey coccidiosis vaccine is intended to provide optimum protection with minimal post-vaccination reaction. The oocyst suspension can be administered orally or by hatchery spray.

According to Dr. Steven Clark, Turkey Technical Services Manager at Huvepharma, “Turkey coccidiosis continues to be a top concern of the industry.” He added, “We are proud to produce another approach to control coccidiosis in turkeys.”

The Huvepharma turkey coccidiosis vaccine is the only available product providing protection against three Eimeria species that impact turkeys. Coccidiosis interacts with viral, protozoal and bacterial intestinal pathogens. Coccidiosis is a significant detractor from live performance and hence profitability.

|

Plant Owner now Liable for $3.8 Million over Wage Theft

|

|

Tony Bran the owner of five poultry processing plants in La Puente and City of Industry, CA is apparently liable for back wages totaling $3.8 million. Bran’s companies include Exclusive Poultry, Meza Poultry, Valtrierra Poultry, Sullon Poultry, Nollus’s Poultry.

The Department of Labor (DOL) Wage and Hour Division investigated the companies and has determined that workers were underpaid from August 1, 2020 and September 28, 2023.

Bran allegedly employed workers as young as 14 years of age to perform deboning that is forbidden as a “dangerous job” classification. Minors employed in the plants worked beyond statutory hourly limits were not paid overtime. In addition Bran’s companies retaliated against employees who cooperated with DOL investigators.

|

Comparison of Fast Versus Slow Broiler Growth

|

|

A preliminary release on April 15th by USPOULTRY addressed Project #719 Longitudinal Assessment of Skeletal and Cardiac Structures in Broilers Reared Under Slow Versus Fast Growth Rate Regimen and its Relation to Lameness, Ascites and Woody Breast Condition. A preliminary release on April 15th by USPOULTRY addressed Project #719 Longitudinal Assessment of Skeletal and Cardiac Structures in Broilers Reared Under Slow Versus Fast Growth Rate Regimen and its Relation to Lameness, Ascites and Woody Breast Condition.

The study conducted by Dr. Prafulla Regmi of the Department of Poultry Science, University of Georgia addressed critical issues in live broiler production. Due to the restrictions placed by major journals on release of specific data prior to publication, publication of results will be deferred to an appropriate time. The USPOULTRY release did however include the comment that restricting growth rate can influence welfare parameters but the frequently quoted 50 g per day growth rate promoted by welfare activists is invalid. The breaking strength of bones is not increased by reducing growth rate.

CHICK-NEWS will review the article and its implications on publication and will comment on data in relation to production programs.

|

Aviagen Presenting Focused Workshops

|

|

Aviagen in collaboration with Jamesway Incubator Company presented a hatchery workshop on April 8th to 11th at the Aviagen Development and Training Center in Albertville, AL. Presenters included members of the Aviagen Global Incubation Team and specialists affiliated with Jamesway. Aviagen in collaboration with Jamesway Incubator Company presented a hatchery workshop on April 8th to 11th at the Aviagen Development and Training Center in Albertville, AL. Presenters included members of the Aviagen Global Incubation Team and specialists affiliated with Jamesway.

Eddy van Lierde, Global head of Incubation Services stated, “Attendees at the North American Hatchery Workshop experienced a blend of theoretical knowledge and practical insight into embryo development to improve hatchery performance.” He added, “Aviagen is committed to ensuring our customers’ success providing them with the latest technology to achieve continuous improvement in their hatchery and businesses.”

Dr. Keith Bramwell, Director of Hatchery Consultancy for Jamesway observed, “We are honored to collaborate with Aviagen on this well-attended workshop. It is always a pleasure to share our knowledge with hatchery managers and improve operations.” Dr. Keith Bramwell, Director of Hatchery Consultancy for Jamesway observed, “We are honored to collaborate with Aviagen on this well-attended workshop. It is always a pleasure to share our knowledge with hatchery managers and improve operations.”

Aviagen will collaborate with allied industry suppliers to present short modules that will complement the production courses including the month-long Production Management School. The focused modules will be presented throughout the year and will address specific management topics benefiting Aviagen customers.

|

Processor Sues City of Dawsonville, GA.

|

|

Generally public authorities sue processors in the event of contamination arising from wastewater discharge. In a recent legal action Gold Creek Foods, LLC. filed a lawsuit against the City of Dawsonville, GA over surcharges, penalties and threatened termination of water and sewer service. Gold Creek Farms has operated in Dawsonville for two decades and uses close to 200,000 gallons of water each week.

In their petition, the Company noted that termination of water would result in displacement of 400 employees. Gold Creek Foods disputes the justification for surcharges and penalties relating to the quality of wastewater from the plant. The Company pre-treats wastewater before discharging to the City sewer system and wastewater complies with EPA standards. The Company maintains that testing carried out by the City is inappropriate and discriminates against Gold Creek Foods, the sole source of industrial wastewater.

|

|

Interview with Dr. James Barton- Promoting Ancera Technology to Monitor Pathogens

|

|

Dr. James Barton has gained extensive experience in the poultry industry in the Southeast and California regions of the industry. He is currently applying Ancera technology to solving practical problems throughout the poultry industry. Recently EGG-NEWS had the opportunity to review his activities in the areas of reducing the impact of coccidiosis and Salmonella infection.

CHICK-NEWS: James, please share your background and experience with our Subscribers.

Dr. James Barton: My earliest memories of poultry production involved visits to the Animal Science Building at the University of Arkansas with my father Dr. Lionel Barton, who was the Extension Poultry Specialist for the state. At an early stage I realized that poultry was a growing industry and wanted to contribute to progress in feeding people.

CHICK-NEWS: Your formal training?

Dr. James Barton: After three years of a pre-veterinary BS in Agriculture at the University of Arkansas I entered the LSU School of Veterinary Medicine, graduating in 1990. I applied for and completed a residency in poultry veterinary medicine through the University of California Diagnostic Laboratory System. This enabled me to gain experience in broilers, egg production and turkeys. Satisfying requirements, I earned Diplomate status in the American College of Poultry Veterinarians in 1992. Subsequent practical experience allowed me to become a Charter Diplomate of the American College of Animal Welfare.

CHICK-NEWS: Please describe your industry experience.

Dr. James Barton: My first professional appointment was with Indian River in Texas as the veterinarian responsible for flock health and technical service both in the U.S. and for international customers. I accepted a position with Zacky Farms in California working with broilers and turkeys as the company veterinarian. I was subsequently offered and accepted a position with Cargill Turkeys in Arkansas that involved nine years of managing flock health, establishing a Salmonella control program, and initiating an animal welfare program. From 2006 to 2009 I was responsible for flock welfare at Tyson Foods, requiring the implementation of procedures to demonstrate compliance with the emerging animal welfare expectations of customers and society. At the request of the Arkansas Poultry Federation, I modernized the NPIP-approved laboratory while maintaining a consulting practice in the broiler, turkey, and layer industry.

CHICK-NEWS: When did you join Ancera?

Dr. James Barton: I was excited to become a member of the Ancera team in 2020 because of their advanced technology that offered food producers the opportunity to focus pathogen monitoring on financial objectives. Ancera’s platforms provide insights that enable better decision making to maximize profits by lowering cost and increasing production. Through the unique coccidia-monitoring program, it is possible to quantify the amount of coccidia exposure so that live production managers and vets can move off a failing program quicker and stay on an effective program longer. Optimizing coccidia control has become even more necessary with the adoption of drug-free and NAE broiler production.

CHICK-NEWS: How is the program implemented?

Dr. James Barton: Individual fecal samples are analyzed at our laboratories with a novel diagnostic device called PIPER, which specializes in high-quality, high-throughput microbial enumeration techniques. The basic oocyst per gram data are converted into a graphical image representing the status of the house, farm, and complex over time. More importantly, Bayesian modeling expresses the current coccidia control status relative to optimal performance expected from the specific control program.

CHICK-NEWS: Ancera is now applying technology to monitor Salmonella. Please elaborate.

Dr. James Barton: Ancera has acquired the global commercial rights for technology developed by Dr. Nikki Shariat at the University of Georgia which involves identification of the CRISPR gene sequences that are unique to Salmonella serotypes. By commercializing this technology and building a user-friendly software platform, our first integrator customers are monitoring the prevalence of their KPI serotypes and getting new visibility into transmission risk patterns. Ancera believes that the future of pre-harvest control of Salmonella infection will depend on recognizing that each Salmonella serotype has a specific behavior – rather than trying to treat Salmonella as a generic organism. Because traditional Salmonella culture techniques select for the serotypes that are best adapted to artificial media, the presence of multiple serotypes within a flock is overlooked very, very often. The serotypes that are missing detection in the live flocks can be the ones that are problematic in post-chill carcasses, parts, and ground poultry meat. Ancera believes that it is necessary to have a close relationship between poultry health and quality control teams within a production company to achieve effective control of potential foodborne pathogens.

CHICK-NEWS: What does Ancera offer for the future?

Dr. James Barton: We are very close to launching an assay for Total Viable Bacteria (TVB) that will be independent of culture technology. We are also well down the path of developing a quantitative assay for Clostridium perfringens based on fecal counts that will be valuable in managing programs to inhibit necrotic enteritis and potentially related infections. Finally, we regularly hear from customers about the need to objectively understand whether their vendors’ products used in control programs and interventions are working as intended. We’re excited to share some new developments in this area shortly.

CHICK-NEWS: Do you have any observations based on your extensive experience?

Dr. James Barton: The post-DVM training programs should reevaluate the advanced education of poultry veterinarians given the need to base technical decisions on the financial performance in an industry that continues to undergo consolidation. It is imperative that technical experts become even more involved in quantifying the return on investment from products and management practices – driving the management decisions with effective messaging, based on high quality evidence.

|

No Cardio-Metabolic Benefits From Plant-Based Meat Analogs

|

|

In an eight-week longitudinal study conducted in Singapore, no beneficial effect could be attributed to substitution of an omnivorous animal-based meat diet with plant-based meat analogues. The study was conducted over eight weeks, and involved 82 participants with an elevated risk of diabetes. In an eight-week longitudinal study conducted in Singapore, no beneficial effect could be attributed to substitution of an omnivorous animal-based meat diet with plant-based meat analogues. The study was conducted over eight weeks, and involved 82 participants with an elevated risk of diabetes.

The trial demonstrated a significant interaction (time x treatment) for dietary trans-fat that was increased with the animal-based diet. In contrast, fiber, sodium and potassium all increased with the plant-based meat analog diet. Glycemic homeostasis was better regulated in the subjects consuming the animal-based meat diet. Substitution of plant-based meat analogues in the diet had no effect on lipoprotein profile including low-density lipoproteins and cholesterol.

Health claims made by proponents of plant-based meat analogs will require careful review by health professionals, the FDA and health conscious consumers. This is especially important with respect to labels and advertising claims.

|

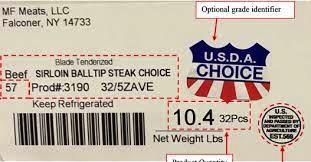

Missouri Plant Protein Labeling Statute Upheld

|

|

The U.S. District Court for the Western district of Missouri ruled as constitutional the 2018 statute relating to potential misrepresentation of vegetable-based products as meat. The U.S. District Court for the Western district of Missouri ruled as constitutional the 2018 statute relating to potential misrepresentation of vegetable-based products as meat.

The Missouri statute, according to the court, did not prohibit commercial speech and was in accordance with the First Amendment. Turtle Island Foods, manufacturer of Tofurky, clearly labels its product as being ‘plant-origin’.

Missouri Attorney General, Andrew Bailey, stated, “Ensuring that the truth of products sold within the state of Missouri is of importance to both consumers and the farmers and ranchers that produce food.” The Missouri Cattlemen’s Association welcomed the judgment, noting “The legislation in no way prohibited the sale of consumption of these imitation products but it did require truthful and accurate labeling. Misleading consumers is unacceptable.” Missouri Attorney General, Andrew Bailey, stated, “Ensuring that the truth of products sold within the state of Missouri is of importance to both consumers and the farmers and ranchers that produce food.” The Missouri Cattlemen’s Association welcomed the judgment, noting “The legislation in no way prohibited the sale of consumption of these imitation products but it did require truthful and accurate labeling. Misleading consumers is unacceptable.”

Opponents of restricted legislation maintain that consumers are not confused by meat substitutes with labels that clearly indicate plant-based origin. These products are usually placed in display areas separate from animal-derived meat and with clear labeling of packages.

|

Brazil to Expand Production and Exports in 2024

|

|

According to USDA-FAS GAIN Report BR2024-0002, Brazil will increase broiler production to 15.10 million metric tons (33.22 million lbs.) of RTC, an increase of 1.3 percent over 2023. Of this total, 33.0 percent will be exported amounting to 4.975 million metric tons (10.94 million lbs.) or an increase of 4.3 percent over 2023. Assuming a population of 220 million, domestic per capita consumption will be 46.0 kg (101.3 lb.). According to USDA-FAS GAIN Report BR2024-0002, Brazil will increase broiler production to 15.10 million metric tons (33.22 million lbs.) of RTC, an increase of 1.3 percent over 2023. Of this total, 33.0 percent will be exported amounting to 4.975 million metric tons (10.94 million lbs.) or an increase of 4.3 percent over 2023. Assuming a population of 220 million, domestic per capita consumption will be 46.0 kg (101.3 lb.).

The GAIN Report noted that in 2023, feed cost representing 68 percent of live-bird cost declined by 22 percent with a corresponding 14 percent drop in chick cost representing 15 percent of live bird cost. The major increase was a 13 percent rise in the cost of electrical power that represented 2.5 percent of live bird cost.

With regard to exports, Brazil introduced electronic certification for the E.U. that will expedite approval of shipments and reduce cost. The Brazilian Association of Animal Protein (ABPA) noted expansion into new markets including Israel, the Pacific Islands and Algeria. In the case of this nation, Brazil donated 10,000 metric tons of chicken meat as a humanitarian gesture and to gain a foothold in the market.

For 2023, the top importers of chicken from Brazil comprised China (14 %); UAE (9%); Japan (9%); Saudi Arabia (8%) and South Africa (7%).

Brazil has apparently benefited from its status as “free of avian influenza in commercial farms”.

This situation is questioned since the nation reported 158 cases of H5N1 HPAI in backyard flocks and wild birds but miraculously none in commercial flocks. Eight states reported HPAI including all the major broiler producing areas.

|

Vegan Promoters Ambivalent over Florida Cultured Meat

|

|

Legislation banning the sale of cell-cultured meat in Florida, will take effect on July 1st, 2024. This legislation is essentially a “feel-good” measure in response to political pressure since there will not be any commercially available cell-cultured meat on July 1st, 2024, or for that matter, in the foreseeable future.

Vegan advocates consider that cell-cultured meat would be an improvement over conventional beef, pork and chicken based on welfare and environmental criteria. Organizations opposing  animal agriculture are also pushing the health aspects of non-meat diets citing an unproven scientific relationship between intake of dietary cholesterol and cardiovascular disease in otherwise healthy consumers. animal agriculture are also pushing the health aspects of non-meat diets citing an unproven scientific relationship between intake of dietary cholesterol and cardiovascular disease in otherwise healthy consumers.

|

Delmarva Producers to Improve Environmental Management Practices

|

|

The Delmarva Chicken Association and the Alliance for the Chesapeake Bay will fund a $2 million program over three years to promote best management practices for producers on the Delmarva Peninsula.

Funds will be used to improve riparian buffers and apply enhanced conservation, drainage and litter management. The intent is to reduce the release of nitrogen and phosphorous into Chesapeake Bay.

Participating farmers will be eligible for cost-share conservation initiatives including planting of trees, establishing pollinator areas between houses and around retention ponds. Participating farmers will be eligible for cost-share conservation initiatives including planting of trees, establishing pollinator areas between houses and around retention ponds.

|

Chick-fil-A Antibiotic Transition from NAE to NAIHM

|

|

Chick-fil-A has dropped the strict No Antibiotics Ever (NAE) to a modified No Antibiotics Important to Human Medicine (NAIHM). The Company has not specified the compounds that will be allowed but if this includes ionophore anticoccidial there will be a benefit to producers with no adverse effect for consumers. Ionophores are not regarded as “antibiotics” in the E.U. but because the compound suppresses some intestinal bacteria they were unjustifiably included as “antibiotics”, with respect to the FDA classification. If the Chick-fil-A standard allows the use of feed additive bacitracin, there will be no deleterious effect since this compound is not used for human medicine other than as a topical application and does not contribute to the emergence of antibiotic resistance. Inclusion of bacitracin in broiler diets will suppress Clostridium spp. responsible for necrotic enteritis and gangrenous dermatitis. Chick-fil-A has dropped the strict No Antibiotics Ever (NAE) to a modified No Antibiotics Important to Human Medicine (NAIHM). The Company has not specified the compounds that will be allowed but if this includes ionophore anticoccidial there will be a benefit to producers with no adverse effect for consumers. Ionophores are not regarded as “antibiotics” in the E.U. but because the compound suppresses some intestinal bacteria they were unjustifiably included as “antibiotics”, with respect to the FDA classification. If the Chick-fil-A standard allows the use of feed additive bacitracin, there will be no deleterious effect since this compound is not used for human medicine other than as a topical application and does not contribute to the emergence of antibiotic resistance. Inclusion of bacitracin in broiler diets will suppress Clostridium spp. responsible for necrotic enteritis and gangrenous dermatitis.

It  will be interesting to observe consumer response to the change in policy that will probably rise to the level of a large yawn. This will hold providing the chain maintains quality and value and can assure customers of ongoing welfare in production that conforms to the NCC standards. will be interesting to observe consumer response to the change in policy that will probably rise to the level of a large yawn. This will hold providing the chain maintains quality and value and can assure customers of ongoing welfare in production that conforms to the NCC standards.

The action by Chick-fil-A parallels the earlier announcement by Panera Bread and could initiate a trend among QSRs and mid-priced supermarket chains to adopt a more realistic policy on antibiotics consistent with scientific and financial realities.

|

Chicken Walnut Salad Recalled

|

|

Taylor Farms has recalled ten tons of ready-to-eat apple walnut chicken salad due to non-label disclosure of wheat. Affected product was manufactured between February 28th and March 9th and marketed in Kroger stores in twelve western states. Taylor Farms has recalled ten tons of ready-to-eat apple walnut chicken salad due to non-label disclosure of wheat. Affected product was manufactured between February 28th and March 9th and marketed in Kroger stores in twelve western states.

Product recalls are usually attributed to contamination with pathogens, the presence of foreign material or improper labeling. Misbranding involving the inclusion of a non-declared allergens is a self-inflicted wound and can be avoided by appropriate quality control and coordination within a company. Product recalls are usually attributed to contamination with pathogens, the presence of foreign material or improper labeling. Misbranding involving the inclusion of a non-declared allergens is a self-inflicted wound and can be avoided by appropriate quality control and coordination within a company.

|

Freirich Foods Files for Bankruptcy Protection

|

|

Freirich Foods, a family-owned enterprise established in 1921, recently filed for Chapter 11 bankruptcy protection. This action was taken following a $7 million loss arising from 1.2 million pounds of product that was mishandled by a third-party cold storage company. Freirich Foods, a family-owned enterprise established in 1921, recently filed for Chapter 11 bankruptcy protection. This action was taken following a $7 million loss arising from 1.2 million pounds of product that was mishandled by a third-party cold storage company.

The filing will allow the company to restructure finances, maintain solvency and to restore profitability for the benefit of the owners, creditors and indirectly, 100 workers.

In a statement, the CEO noted, “Bankruptcy protection will enable our company to safeguard our business, employees, customers, and partners while we seek to recover our financial loss and propose a plan to restructure debt and renegotiate contracts. We will emerge from this process with a stronger balance sheet”. In a statement, the CEO noted, “Bankruptcy protection will enable our company to safeguard our business, employees, customers, and partners while we seek to recover our financial loss and propose a plan to restructure debt and renegotiate contracts. We will emerge from this process with a stronger balance sheet”.

It is questioned whether the company can recover the loss through insurance or a lawsuit alleging negligence.

|

Department of Labor Aggressively Investigating Child Labor

|

|

The Department of Labor has filed lawsuits against three California poultry processors alleging violations of child labor law. The Wages and Hours Division has been reviewing plant employment records and conducting inspections uncovering “oppressive child labor at poultry processing facilities.” According to the submissions by the Department of Labor the three companies concerned employed children under the age of 18 to debone poultry in contravention of child labor laws. The Department of Labor has filed lawsuits against three California poultry processors alleging violations of child labor law. The Wages and Hours Division has been reviewing plant employment records and conducting inspections uncovering “oppressive child labor at poultry processing facilities.” According to the submissions by the Department of Labor the three companies concerned employed children under the age of 18 to debone poultry in contravention of child labor laws.

Defendants include L&Y Food Inc., Moon Poultry Inc. and JCR Culinary Group Inc. and their three respective managers in their personal capacities.

The Department of Labor was granted an injunction embargoing products from the plants although there was evidence that the restraining order was defied. The Agency alleged that the defendants obstructed investigations including review of employment data.

|

Contractor Lawsuit Dismissed

|

|

A July 2022 lawsuit filed in Federal court in Georgia against Perdue Farms was recently dismissed. Roger Parker the Plaintiff, claimed misclassification as an “independent contractor” and that the Company retaliated by terminating his contract for registering complaints under the Packers’ and Stockyards Act. The Plaintiff, also claimed improper compensation due to under-weighing of broilers delivered. A July 2022 lawsuit filed in Federal court in Georgia against Perdue Farms was recently dismissed. Roger Parker the Plaintiff, claimed misclassification as an “independent contractor” and that the Company retaliated by terminating his contract for registering complaints under the Packers’ and Stockyards Act. The Plaintiff, also claimed improper compensation due to under-weighing of broilers delivered.

Parker held that since contractors are “treated like employees” they should receive employee benefits including overtime. This is a somewhat fallacious characterization given the nature of the relationship between the contractor who supplies housing, labor and utilities and the integrator providing chicks and feed and extending service as defined in the contract.

Parker was unable to establish a Class for the lawsuit as he faced understandable lack of interest among contractors willing to participate in the litigation.

|

Hormel Foods Agrees to $11.7 Million Settlement

|

|

Hormel Foods has agreed to pay three classes of Plaintiffs in a suit alleging collusion on pork prices. Commercial indirect purchasers will receive $2.4 million, direct pork purchasers, $4.8 million and consumer indirect purchasers, $4.5 million. Hormel Foods has agreed to pay three classes of Plaintiffs in a suit alleging collusion on pork prices. Commercial indirect purchasers will receive $2.4 million, direct pork purchasers, $4.8 million and consumer indirect purchasers, $4.5 million.

Collectively, there were 146 claimants in 27 cases that were consolidated during December 2022.

The settlement by Hormel Foods follows a June agreement by Seaboard Foods to pay the class of direct purchasers $9.8 million to settle the lawsuit.

|

Tyson Foods Responds to Questionable Claim by Cody Easterday

|

|

Cody Easterday currently serving an 11-year prison sentence for defrauding Tyson Foods of $144 million has filed suit against the Company. At issue, is a claim that Easterday was offered a share of the profits from sales of meat products designated “Cody’s Beef” marketed in Japan. Cody Easterday currently serving an 11-year prison sentence for defrauding Tyson Foods of $144 million has filed suit against the Company. At issue, is a claim that Easterday was offered a share of the profits from sales of meat products designated “Cody’s Beef” marketed in Japan.

Cody claimed $100 million for using his name and image on product labels. His original filing with the U.S. Court of Appeals for the Ninth Circuit was dismissed but Easterday is persisting in his litigation. Tyson Foods categorically rejects the claim based on the absence of any proof relating to any obligation by Tyson Foods to share in profits.

|

Costco Changes Packaging for Rotisserie Chicken

|

|

Costco is undertaking a five-year action plan to reduce the use of plastic packaging. The company markets close to 150 million rotisserie chickens annually, currently presented in two-part PET containers. Following test in Canada, the Company has introduced a flexible plastic bag with insulating capability for their chickens. The change will reduce plastic use for this application by 75 percent, representing a saving of 17 billion pounds of resin annually and a reduction of 4,000 metric tons of carbon dioxide released. This, according to a Company claim will be equivalent to the output of 1,000 trucks annually when fully implemented across 850 warehouses globally. Costco is undertaking a five-year action plan to reduce the use of plastic packaging. The company markets close to 150 million rotisserie chickens annually, currently presented in two-part PET containers. Following test in Canada, the Company has introduced a flexible plastic bag with insulating capability for their chickens. The change will reduce plastic use for this application by 75 percent, representing a saving of 17 billion pounds of resin annually and a reduction of 4,000 metric tons of carbon dioxide released. This, according to a Company claim will be equivalent to the output of 1,000 trucks annually when fully implemented across 850 warehouses globally.

Tim Wahlquist responsible for Costco packaging stated, “The goal is to reduce packaging waste while still protecting products, ensuring food safety and complying with laws and regulations. As a corporate policy, Costco will replace plastic packaging with potentially recyclable content as feasible alternatives become available.

|

Integrators Settle Over Wage Claims

|

|

Case Foods and Mountaire Farms have agreed to pay $8.5 million and $13.5 million respectively to the class of workers alleging collusion in setting wage rates. Case Foods and Mountaire Farms have agreed to pay $8.5 million and $13.5 million respectively to the class of workers alleging collusion in setting wage rates.

The lawsuit was filed in 2019 and claimed interaction among employers to agree on wage rates and to indirectly share information through AgriStats®.

Recently Perdue Farms settled for $60 million, but there are eighteen integrators still named as defendants.

|

Proposed California Ban on Locomotive Emissions Opposed

|

|

The California Air Resources Board (CARB) has requested the EPA to allow California to issue regulations to limit emissions by locomotives. The proposed requirements would include:- The California Air Resources Board (CARB) has requested the EPA to allow California to issue regulations to limit emissions by locomotives. The proposed requirements would include:-

- Decommissioning of locomotives older than 23 years at the beginning of 2030,

- Impose reporting requirements and administrative fees

- Require railroads to shut down other than zero-emission locomotives when transiting in certain areas.

The proposal has resulted in considerable opposition including the National Chicken Council and ninety federal and state agencies and infrastructure associations. A joint letter to the Director of the EPA stated, “If the CARB regulations are authorized by EPA, we believe freight rail carriers and their customers would be significantly hindered financially and operationally”. Clearly the proposed requirements presume technology that is currently unavailable or will be impractical to implement.

The proposed CARB restrictions appear to be preempted by federal law that allows the Surface Transportation Board to exercise jurisdiction over the operation and activities of freight railroads in interstate commerce.

Subscribers will recall the difficulties encountered by Foster Farms in obtaining adequate quantities of corn due to reduced rail transport during COVID and 2023 labor action against railroad operators, resulting in litigation and appeals to the Surface Transportation Board.

|

India to Allow Importation of Duck Meat

|

|

According to USDA-FAS GAIN report IN2024-0015 released on March 25th India will allow importation of duck meat. During early March, the Ministry of Commerce and Industry authorized imports of premium frozen duck meat in accordance with a harmonized tariff system. According to USDA-FAS GAIN report IN2024-0015 released on March 25th India will allow importation of duck meat. During early March, the Ministry of Commerce and Industry authorized imports of premium frozen duck meat in accordance with a harmonized tariff system.

Import duties for duck meat have been reduced with expectations of shipments to the Nation from the U.S albeit it in competition from producers in the E.U. and Asian nations including Thailand and China. Import duties for duck meat have been reduced with expectations of shipments to the Nation from the U.S albeit it in competition from producers in the E.U. and Asian nations including Thailand and China.

|

KFC Introducing Saucy Nuggets

|

|

KFC has introduced five new sauces for their white-meat chicken nuggets. Priced at $5.99 for ten, Saucy Nuggets are available with one of three new flavors and two held over by demand. They include honey sriracha, Korean BBQ, sweet and sour, natural hot and Georgia gold honey mustard. KFC has introduced five new sauces for their white-meat chicken nuggets. Priced at $5.99 for ten, Saucy Nuggets are available with one of three new flavors and two held over by demand. They include honey sriracha, Korean BBQ, sweet and sour, natural hot and Georgia gold honey mustard.

|

Risk Assessment Recommends Concentration on Virulent Salmonella Serotypes

|

|

A recent study by Dr. Matthew Stasiewicz at the University of Illinois indicated that regulatory concentration on high levels of known virulent Salmonella serotypes would benefit public health. To date, Salmonella standards have been based on prevalence resulting in an evident reduction in recovery from processed poultry. Unfortunately there has not been a corresponding reduction in the incidence rate of chicken-related salmonellosis among consumers. A recent study by Dr. Matthew Stasiewicz at the University of Illinois indicated that regulatory concentration on high levels of known virulent Salmonella serotypes would benefit public health. To date, Salmonella standards have been based on prevalence resulting in an evident reduction in recovery from processed poultry. Unfortunately there has not been a corresponding reduction in the incidence rate of chicken-related salmonellosis among consumers.

The risk assessment concluded that specific products with high levels of pathogenic serotypes should receive attention in order to develop appropriate control modalities. Dr. Stasiewicz suggested that programs focusing on generic prevalence of Salmonella may contribute to the emergence of more pathogenic serotypes such as Salmonella Kentucky. The risk assessment concluded that specific products with high levels of pathogenic serotypes should receive attention in order to develop appropriate control modalities. Dr. Stasiewicz suggested that programs focusing on generic prevalence of Salmonella may contribute to the emergence of more pathogenic serotypes such as Salmonella Kentucky.

The risk assessment was supported by a grant from the USPOULTRY Foundation.

|

Federal Agencies Issue MOU on Animal Welfare

|

|

The Environmental and Natural Resources Division of the Department of Justice (DOJ); the USDA Animal and Plant Health Inspection Service (APHIS) and the USDA Office of General Counsel have issued a Memorandum of Understanding (MOU) on civil and judicial implementation of the Animal Welfare Act. In the event of an overlap among federal agencies, MOUs designate the relative jurisdiction and responsibilities and coordination of activities including the sharing of information and enforcement. The Environmental and Natural Resources Division of the Department of Justice (DOJ); the USDA Animal and Plant Health Inspection Service (APHIS) and the USDA Office of General Counsel have issued a Memorandum of Understanding (MOU) on civil and judicial implementation of the Animal Welfare Act. In the event of an overlap among federal agencies, MOUs designate the relative jurisdiction and responsibilities and coordination of activities including the sharing of information and enforcement.

Following an infraction of the Animal Welfare Act the Federal government can implement civil action through the DOJ requiring federal district court action. In most cases, the APHIS can pursue administrati ve enforcement that can involve a warning with a settlement agreement with or without imposing a monetary penalty. APHIS has the authority to suspend or revoke licenses, issue cease-and-desist orders and impose civil penalties through the administrative law process. ve enforcement that can involve a warning with a settlement agreement with or without imposing a monetary penalty. APHIS has the authority to suspend or revoke licenses, issue cease-and-desist orders and impose civil penalties through the administrative law process.

The MOU establishes a priority for repeat offenders and egregious violators. Plants that will receive attention include facilities with a history of multiple citations or involving noncompliance. Licensees considered for suspension will have previously denied inspectors access or operate with defective records or exhibit a pattern of interference with inspectors. The MOU will facilitate coordinated action by the agencies involved.

The MOU is probably a response to a petition by animal rights and welfare organizations to allow local law enforcement and judicial agencies to intervene in cases of alleged deviations from the Animal Welfare Act. The MOU is probably a response to a petition by animal rights and welfare organizations to allow local law enforcement and judicial agencies to intervene in cases of alleged deviations from the Animal Welfare Act.

Additional information can be obtained from the APHIS website www.aphis.usda.gov/awa/enforcement

|

Veterinary Welfare Association Supports Petition to FSIS

|

|

In September 2023, animal welfare association Animal Partisan filed a petition with FSIS urging local and state investigation and prosecution of overt abuse of livestock in abattoirs. The Veterinary Association of Farm Animal Welfare (VAFAW) supports the petition but deviates from Animal Partisan in maintaining that states do not have the right to supersede federal officials with respect to oversight of welfare. The VAFAW has requested the FSIS to interact with local and state agencies in the event of any deviations from the Federal Meat and Poultry Inspection Acts. In September 2023, animal welfare association Animal Partisan filed a petition with FSIS urging local and state investigation and prosecution of overt abuse of livestock in abattoirs. The Veterinary Association of Farm Animal Welfare (VAFAW) supports the petition but deviates from Animal Partisan in maintaining that states do not have the right to supersede federal officials with respect to oversight of welfare. The VAFAW has requested the FSIS to interact with local and state agencies in the event of any deviations from the Federal Meat and Poultry Inspection Acts.

USDA inspectors are empowered to close plants by suspending inspection in the  event of abuse. Referring cases to local or state officials is a reasonable action and could serve to strengthen welfare by focusing management attention on this aspect of plant operations. event of abuse. Referring cases to local or state officials is a reasonable action and could serve to strengthen welfare by focusing management attention on this aspect of plant operations.

|

USPOULTRY Approve Research Projects

|

|

In an April 8th release, USPOULTRY and the USPOULTRY Foundation approved funding amounting to $363,000 for three research projects dealing with poultry meat production. These comprised: - In an April 8th release, USPOULTRY and the USPOULTRY Foundation approved funding amounting to $363,000 for three research projects dealing with poultry meat production. These comprised: -

- Necrotic enteritis in chickens: understanding the immunological basis of host immunity North Carolina State University

- Cross-sectional and longitudinal epidemiologic investigations of Ornithobacterium in commercial turkeys. Iowa State University

- Technology for poultry hatcheries to simultaneously deliver vaccines and prebiotics. University of Delaware

|

E.U. Broiler Production in 2024

|

|

According to USDA-FAS GAIN Report E42024-06 released on February 27th, projected broiler production among E.U. nations will increase by 0.8 percent from calendar 2023 to 11.11 million metric tons. Imports will attain 750,000 metric tons representing 6.8 percent of production. Exports will rise to 1.67 million metric tons or 15 percent of production. Net exports will therefore represent 8.2 percent of production at 0.92 million metric tons. Given an E.U. population of 450 million, projected per capita consumption will amount to 22.6 kg (49.8 lb.) approximately half that of U.S. consumption. According to USDA-FAS GAIN Report E42024-06 released on February 27th, projected broiler production among E.U. nations will increase by 0.8 percent from calendar 2023 to 11.11 million metric tons. Imports will attain 750,000 metric tons representing 6.8 percent of production. Exports will rise to 1.67 million metric tons or 15 percent of production. Net exports will therefore represent 8.2 percent of production at 0.92 million metric tons. Given an E.U. population of 450 million, projected per capita consumption will amount to 22.6 kg (49.8 lb.) approximately half that of U.S. consumption.

Restraints to output include highly pathogenic avian influenza that has persisted since 2021. Other hindrances include environmental restraints with limits on nitrogen emissions in the Netherlands and Belgium. Although the price of ingredients has declined, production costs in France remain high and are limiting output. Economists forecast increase demand for chicken based on the competitive price and availability of pork and beef.

A major issue of contention is the importation of chicken from Ukraine without duty following E.U. regulation 2023/1077. Poland, the largest producer in the E.U. has requested limits on the importation of broiler products from their eastern neighbor.

Although the U.K. represents a strong market for E.U. chicken, supplied mainly from Poland and Germany, there is now increased supply from Brazil, Thailand and Ukraine. Competition from Brazil, the consistently low-cost supplier has eroded markets for the E.U. in Africa, the Middle East and especially South Africa.

|

Superior Farms Faces Denver Ballot Initiative

|

|

Superior Farms has operated within the city of Denver for decades. The company processes mutton and is the last remaining abattoir in the City that once was the terminal of cattle trails hosting extensive stockyards. A 2024 ballot initiative will determine the fate of the company in its present location. The proposed ordinance is intended to eliminate slaughtering operations in the City of Denver. The justification is not on the basis of nuisance, odor, pressure on effluent treatment as would be expected but is advanced by the deliberate misnomer of ‘welfare’. It is evident that the proponents of the ballot initiative are appealing to sentiment with the true agenda of veganism obscured by the concept of welfare. This is evidenced by the wording of the ballot that included “to promote community awareness of animal welfare, bolstering the City’s stance against animal cruelty and in turn to foster a more humane environment in Denver.” Superior Farms has operated within the city of Denver for decades. The company processes mutton and is the last remaining abattoir in the City that once was the terminal of cattle trails hosting extensive stockyards. A 2024 ballot initiative will determine the fate of the company in its present location. The proposed ordinance is intended to eliminate slaughtering operations in the City of Denver. The justification is not on the basis of nuisance, odor, pressure on effluent treatment as would be expected but is advanced by the deliberate misnomer of ‘welfare’. It is evident that the proponents of the ballot initiative are appealing to sentiment with the true agenda of veganism obscured by the concept of welfare. This is evidenced by the wording of the ballot that included “to promote community awareness of animal welfare, bolstering the City’s stance against animal cruelty and in turn to foster a more humane environment in Denver.”

Superior Farms slaughters lambs and processes carcasses through to case presentation. The plant employs 160, of whom 80 percent are Denver residents. Rick Stott, CEO maintains that despite polls showing even levels of either support or rejection “voters will resonate with a message of saying it’s not fair to target a particular business.” Superior Farms operates a facility in Dixon, CA.

Forced closure of the plant in Denver would reduce the supply of domestic lamb to the U.S. market that will simply be substituted by imports from New Zealand and Australia. Even if the ballot initiative fails the proponents will be back in two years. They recognize the vulnerability of Superior Farms and the publicity associated with an eventual victory. Success in pro-vegan ballots generates funding for the organizers and reinforces a feeling of self-satisfaction through aggressively promoting a lifestyle that is opposed to intensive livestock production.

|

Georgia Opposes U.S. EPA Effluent Guidelines

|

|

The Attorney General of Georgia, Chris Carr, has joined 26 other Attorneys General to oppose the Effluent Limitations Guidelines proposed by the U.S. Environmental Protection Agency. The Attorney General of Georgia, Chris Carr, has joined 26 other Attorneys General to oppose the Effluent Limitations Guidelines proposed by the U.S. Environmental Protection Agency.

Opposition to the proposed guidelines is based on the high cost of compliance that would increase the price of meat, poultry and egg products to consumers. It is estimated that with the more stringent guidelines, EPA jurisdiction over 150 processing plants would be increased to 3,000 facilities.