OVERVIEW

Total exports of bone-in broiler parts and feet during January 2024 attained 301,200 metric tons, 4.0 percent lower than in January 2023 (316,629 metric tons). Total value of broiler exports increased by 3.3 percent to $386.8 million ($374,6 million).

Total exports of bone-in broiler parts and feet during January 2024 attained 301,200 metric tons, 4.0 percent lower than in January 2023 (316,629 metric tons). Total value of broiler exports increased by 3.3 percent to $386.8 million ($374,6 million).

Total export volume of turkey products during January 2024 attained 16,684 metric tons, 37.9 percent more than in January 2024 (12,098 metric tons). Total value of turkey exports increased by 3.3 percent to $44.8 million ($42.0 million).

Unit price for the broiler industry is constrained by the fact that leg quarters comprise over 97 percent of broiler meat exports by volume (excluding feet). From the first quarter of 2021 through 2022, unit value of leg quarters increased consistent with international demand followed by a decline in 2023. Leg quarters represent a relatively low-value undifferentiated commodity lacking in pricing power. Exporters of commodities are subjected to competition from domestic production in importing nations. Generic products such as leg quarters are vulnerable to trade disputes and embargos based on real or contrived disease restrictions.

HPAI has emerged as a panornitic affecting the poultry meat industries of four continents with seasonal outbreaks. The distribution in the U.S. limits eligibility for export depending on restrictions imposed by importing nations

Ongoing outbreaks of African swine fever in China and Southeast Asia from early 2019 and Europe from 2010 onwards reduced the availability of pork. In addition, disruptions in chicken production and logistics due to COVID restrictions decreased availability of protein with international repercussions on trade in chicken and pork. The demand for pork imports to China has diminished with restoration of domestic hog production. Mild overproduction is evident in the white-feathered broiler sector with implications for exports other than feet extending into 2024.

Ongoing outbreaks of African swine fever in China and Southeast Asia from early 2019 and Europe from 2010 onwards reduced the availability of pork. In addition, disruptions in chicken production and logistics due to COVID restrictions decreased availability of protein with international repercussions on trade in chicken and pork. The demand for pork imports to China has diminished with restoration of domestic hog production. Mild overproduction is evident in the white-feathered broiler sector with implications for exports other than feet extending into 2024.

EXPORT VOLUMES AND PRICES FOR BROILER MEAT

During January 2024 the National Chicken Council (NCC), citing USDA-FAS data, documented exports of 303,591 metric tons of chicken parts and other forms (whole and prepared), down 3.8 percent from January 2023. Exports were valued at $395.0 million with a weighted average unit value of $1,301 per metric ton.

The NCC breakdown of chicken exports for January 2024 by proportion and unit price for each category compared with the corresponding month in 2023 (with the unit price in parentheses) comprised:-

- Chicken parts (excluding feet) 97.4%; Unit value $1,231 per metric ton ($1,148)

- Prepared chicken 2.0%; Unit value $4,502 per metric ton ($4,183)

- Whole chicken 0.6%; Unit value $1,880 per metric ton ($1,621)

- Composite Total 100.0%; Av. value $1,301 per metric ton ($1,208)

The following table prepared from USDA data circulated by the USAPEEC, compares values for poultry meat exports during January 2024 compared with the corresponding month of 2023:-

|

PRODUCT

|

January 2023

|

January 2024

|

DIFFERENCE

|

|

Broiler Meat & Feet

|

|

|

|

|

Volume (metric tons)

|

313,629

|

301,200

|

-12,429 (-4.0%)

|

|

Value ($ millions)

|

374.6

|

386.8

|

+12.2 (+3.8%)

|

|

Unit value ($/m. ton)

|

1,194

|

1,284

|

+90 (+7.5%)

|

|

Turkey Meat

|

|

|

|

|

Volume (metric tons)

|

12,098

|

16,648

|

+4,550 (+37.6%)

|

|

Value ($ millions)

|

42.0

|

44.8

|

+2.8 (+6.7%)

|

|

Unit value ($/m. ton)

|

3,472

|

2,691

|

-781 (-22.5%)

|

COMPARISON OF U.S. CHICKEN AND TURKEY EXPORTS

JANUARY 2024 COMPARED TO 2023

BROILER EXPORTS

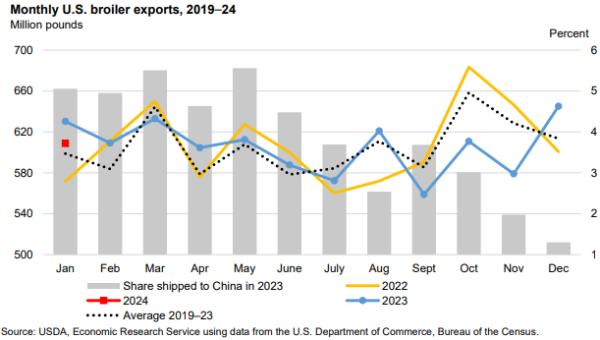

Total broiler parts, predominantly leg quarters but including feet, exported during January 2024 compared with January 2023 declined by 4.0 percent in volume but was up 3.8 percent in value. Unit value was 7.5 percent higher at $1,284 per metric ton.

During 2023 exports attained 3,635,178 metric tons valued at $4,739 million, down 4.2 percent in volume and down 9.2 percent in value compared to 2022. Unit value was down 9.5 percent to $1,284 per metric ton

Broiler imports in 2023 were projected to attain 72,000 metric tons (158 million lbs.)

The top five importers of broiler meat represented 51.4 percent of shipments during January 2024. The top ten importers comprised 68.6 percent of the total volume reflecting concentration among the significant importing nations.

During January 2024 Mexico was the first-ranked importer by volume with 63,059 metric tons representing 20.9 percent of export volume up 0.1 percent from January 2023. Value at $72.4 million was 18.7 percent of the total for exported broiler products during January 2024 and up 21.0 percent from 2023, but with a 21.2 percent increase in unit price to $1,148 per metric ton. Value was up 21.8 percent to $73.0 million with a 30.7 percent increase in unit price to $1,187 per metric ton.

During January 2024 exports to China, 4th-ranked by volume and 2nd-ranked by value represented 6.7 percent by volume and 10.1 percent by value. Exports were down 49.6 percent in volume to 20,302 metric tons and down 40.6 percent in value to $38.9 million compared to January 2023. Unit price was $1,910.

During January 2024 exports to China, 4th-ranked by volume and 2nd-ranked by value represented 6.7 percent by volume and 10.1 percent by value. Exports were down 49.6 percent in volume to 20,302 metric tons and down 40.6 percent in value to $38.9 million compared to January 2023. Unit price was $1,910.

During 2023 exports of all broiler products to China ranked second by volume were 34.3 percent lower by volume to 405,313 metric tons and 34.2 percent lower by value at $711 million compared to 2022. Volume and value of exports to China represented 11.2 percent and 15.0 percent respectively with an average unit price of $1,754 per metric ton. The U.S. average export price during 2023 excluding China was $1,280, demonstrating the weighting of the unit value of feet on average export value.

For 2023, 405,313 metric tons of U.S. broiler products were shipped to China, valued at $711,172 with an average unit value of $1,755 per metric ton. A breakdown of product categories and prices was provided by USAPEEC. Paws and feet represented 68.5 percent of volume and 73.1 percent of value with a unit price of $1,871 per metric ton. Legs and leg quarters comprising 22.6 percent of volume and 12.8 percent of value were priced at $990 per metric ton below the $1,302 average for all U.S. exports excluding China. Wings comprised 4.6 percent of volume and 5.7 percent of value with a unit price of $2,190 per metric ton. All other poultry products (including 4 tons of duck meat) amounting to 4.2 percent of volume and 8.4 percent of value attained an average unit price of $3,485 per metric ton

During January 2023 exports to Hong Kong increased by 278 percent in volume to 7,517 metric tons and 226 percent in value to $11.3 million with a unit price of $1,503 per metric ton. In 2022 and 2023 unit prices were $1,834 and $1,671 per metric ton respectively. Accordingly consignments comprised a high proportion of feet with presumed transshipment to the Mainland as in past years but not apparently in January 2024.

During January 2024 nations gaining in volume compared to the corresponding period in 2022 (with the percentage change indicated) in descending order of volume with ranking indicated by numeral were:-

2. Cuba (+5%); 3.Taiwan, (+57%); 5, Guatemala, (+1%); 6. UAE, (+88%); 7. Philippines, (+62%); 8. Viet Nam, (+55%) and 10. Hong-Kong, (+278%).

Losses during January 2024 offset the gains in exports with declines for:-

1. Mexico, (-0.1%); 4. China, (-50%); 9. Canada, (-7%); 11. Haiti, (-29%); 12. Congo-Brazzaville, (-18%); 13.Angola, (-51%)

TURKEY EXPORTS

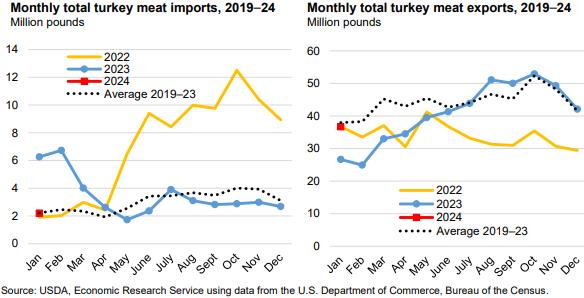

The volume of turkey meat exported during January 2024 increased by 37.6 percent to 12,098 metric tons from January 2023 and value was 6.7 percent higher to $44.8 million compared to January 2024. Average unit value was 22.5 percent higher to $2,697 per metric ton.

Imports of turkey products were projected to rise to 38,640 metric tons in 2023.

For the entire year of 2023 export volume increased by 20.2 percent to 221,098 metric tons compared to 2022 and value fell by 2.0 percent to $620 million reflecting an 18.5 percent decrease in unit value to $2,829 per metric ton.

Mexico was the leading importer of turkey products during January 2024 with 11,766 metric tons representing 70.7 percent of total volume of 16,648 metric tons. Value at 31.5 million was 67.8 percent of the total with a unit price of $3,285 per metric ton. Volume was 40.9 percent higher and value was 3.6 percent higher than for January 2023.

The regions of the Caribbean, East Asia, Middle East and sub-Saharan Africa comprising five nations collectively imported 2,138 metric tons of turkey products in January 2024 representing 12.8 percent of volume and 10.7 percent of value amounting to $44.8 million. Unit price was $2,245. Regional unit prices per metric ton ranged from $1,363 for the Leeward-Windward Islands to $3,418 for the Canada.

During January 2024 nations increasing volumes of purchases, albeit over a small base, compared to the corresponding month in 2023 with ranking comprised:-

- Mexico, (+41%); Leeward-Windward Islands, (+37%); Dominican Republic, (+430%)

2. Canada reduced imports by 21 percent.

PROSPECTS FOR 2024

The March15th 2024 Livestock, Dairy and Poultry Outlook Report, retained the projection for 2023 exports of broiler products to 3.302 million metric tons (7,265 million lbs.). This value represents 15.7 percent of the projected production of 21.083 million metric tons (46,383 million lb.) of broiler RTC by the U.S. industry.

For 2024 exports of broiler products were forecast at 3.256 million metric tons (7,165 million lbs.), equivalent to 15.3 percent of forecast annual production of 21,307 million metric tons (46,875 million lbs.)

Projected export of turkey products in 2023 will be 222,272 metric tons, (489 million lbs.) or 9.0 percent of annual production of 2.481 million metric tons (5,457 million lbs.).

For 2024 exports of turkey products were forecast at 236,400 metric tons (520 million lbs.) equivalent to 9.7 percent of forecast annual production of 2.441 million metric tons (5,370 million lbs.)

It is important to recognize that exports of chicken and turkey meat products to our USMCA partners amounted to $1,264 million in 2021 and $1,647 million during 2022 and $1,696 in 2023. It will be necessary for all three parties to the USMCA to respect the terms of the agreement since punitive action against Mexico or Canada on issues unrelated to poultry products will result in reciprocal action by our trading partners to the possible detriment of U.S. agro-industries.

The emergence of H5N1strain avian influenza virus with a Eurasian genome in migratory waterfowl in all four Flyways during 2022 was responsible for sporadic outbreaks of avian influenza in backyard flocks and serious commercial losses in egg-producing complexes and turkey flocks but to a lesser extent in broilers. The probability of outbreaks of HPAI over succeeding weeks appears unlikely until spring migration of waterfowl. Incident cases will be a function of shedding by migratory and domestic birds and possibly mammals. The extent of protection of commercial flocks at present relies on intensity and efficiency of biosecurity, representing investment in structural improvements and operational procedures. These measures are apparently inadequate to provide absolute protection suggestion the need for preventive vaccination in high-risk areas for egg-producing, breeder and turkey flocks.

|

|

The application of restricted county-wide embargos following the limited and regional cases of HPAI in broilers with restoration of eligibility 28 days after decontamination has supported export volume for the U.S. broiler industry. Exports of turkey products were more constrained with plants processing turkeys in Minnesota, the Dakotas, Wisconsin and Iowa impacted. Most nations have now lifted embargos that were previously placed on entire states or counties as the WOAH mandated post-decontamination period has expired. The challenge will be to gain acceptance for vaccination coupled with surveillance. Recognition that H5N1 HPAI is panornitic in distribution across six continents and is now seasonally or regionally endemic in many nations with intensive poultry production, suggests that vaccination will have to be accepted among trading partners as an adjunct to control measures in accordance with WOAH policy.

|

The live-bird market system supplying metropolitan areas, the presence of numerous backyard flocks, fighting cocks and commercial laying hens allowed outside access, potentially in contact with migratory and now some resident bird species, all represent an ongoing danger to the entire U.S. commercial industry. The live-bird segments of U.S. poultry production represent a risk to the export eligibility of the broiler and turkey industries notwithstanding compartmentalization for breeders and regionalization to counties or states for commercial production.