According to a February 20th USDA-FAS-GAIN Report (SF2024-0004) the Competition Commission of South Africa functioning under the Department of Trade, Industry and Competition will investigate the broiler industry in South Africa. The terms of reference are to determine whether the industry is “impeding, distorting or restricting competition in a way that violates the South African Competition Act.” In a statement on February 6th the Competition Commission believes that “There are market features within several markets in the poultry sector that may undermine competition with material implications for the industry and consumers.”

According to a February 20th USDA-FAS-GAIN Report (SF2024-0004) the Competition Commission of South Africa functioning under the Department of Trade, Industry and Competition will investigate the broiler industry in South Africa. The terms of reference are to determine whether the industry is “impeding, distorting or restricting competition in a way that violates the South African Competition Act.” In a statement on February 6th the Competition Commission believes that “There are market features within several markets in the poultry sector that may undermine competition with material implications for the industry and consumers.”

The Competition Commission recognizes the ongoing demands for bail outs and requests for tariffs and anti-dumping duties. The Commission noted, “while acceding to these demands may protect the domestic industry, it may create negative consequences for consumers generally and low-income consumers in particular that are dependent on chicken for protein.”

The Commission’s Terms of Reference will be to determine whether current policy on protection restricts competition from breeding through to distribution. The Commission review will consider the impact of integration and control over feed and day-old chicks and the situation of small and medium-sized enterprises many of which are owned by “historically disadvantaged persons.” As in the U.S., the Commission will review the relationship between contract growers and integrators and will address “imbalances in bargaining power and information asymmetry”.

The public has been invited to submit comments to guide the investigations and deliberations of the Commission. It is anticipated that a final report will be completed within 18 months in accordance with statutory requirements.

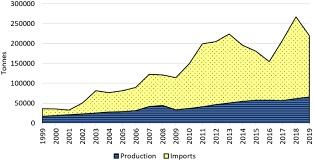

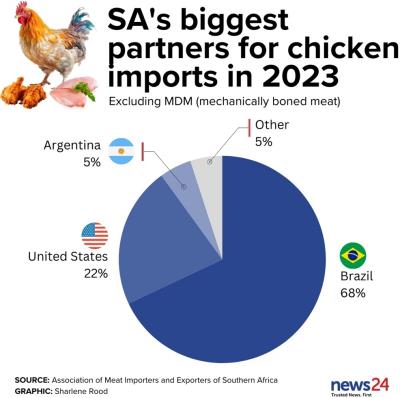

In 2023, South Africa was ranked 18th among importers of U.S. broiler products with shipment of 44,324 metric tons valued at $42.4 million with a unit price of $957 per metric ton. Imports were 20 percent down on volume and 22 percent lower in value compared to 2022. Removal of tariffs and dumping duties would make the U.S. and other exporters more competitive to the disadvantage of the domestic industry. High costs of labor, ingredients and power have resulted in domestic production costs exceeding the landed cost of leg quarters from the U.S. and MDM and whole chicken from Brazil and the E.U. despite the transport differential.

The announcement of the Competition Commission inquiry coincides with a decision by the Trade Administration Commission to introduce rebates on boneless and bone-in chicken to increase supply and reduce cost to consumers.

The decision by the Government to establish an inquiry by the competition commission confirms that the political and lobbying power of the South African Poultry Association is waning.

Effectively the Government of South Africa has essentially thrown the broiler industry under the bus. This reality is based on the Senator Huey Long political principle of a “chicken in every pot”. The African National Congress government is facing extreme opposition from the left based on its inability to govern, the deteriorating economic situation, interruption in power and water supplies and rampant crime. The Government is expected to lose its majority in Parliament following the national election to be held at a yet to be announced date in coming months with the prospect of a coalition among parties.

Effectively the Government of South Africa has essentially thrown the broiler industry under the bus. This reality is based on the Senator Huey Long political principle of a “chicken in every pot”. The African National Congress government is facing extreme opposition from the left based on its inability to govern, the deteriorating economic situation, interruption in power and water supplies and rampant crime. The Government is expected to lose its majority in Parliament following the national election to be held at a yet to be announced date in coming months with the prospect of a coalition among parties.

Recent economic statistics for South Africa suggest a deteriorating situation with gross domestic product down 0.7 percent in 2023, consumer prices up 5.2 percent, an acknowledged unemployment rate of 32 percent, 10.1 percent interest rate on 10-year government bonds and a six percent deterioration in the exchange rate of the SA Rand against the U.S. Dollar